Fitch Ratings says the NSW/Queensland floods will impact insurers’ earnings as more bad weather is predicted for this week.

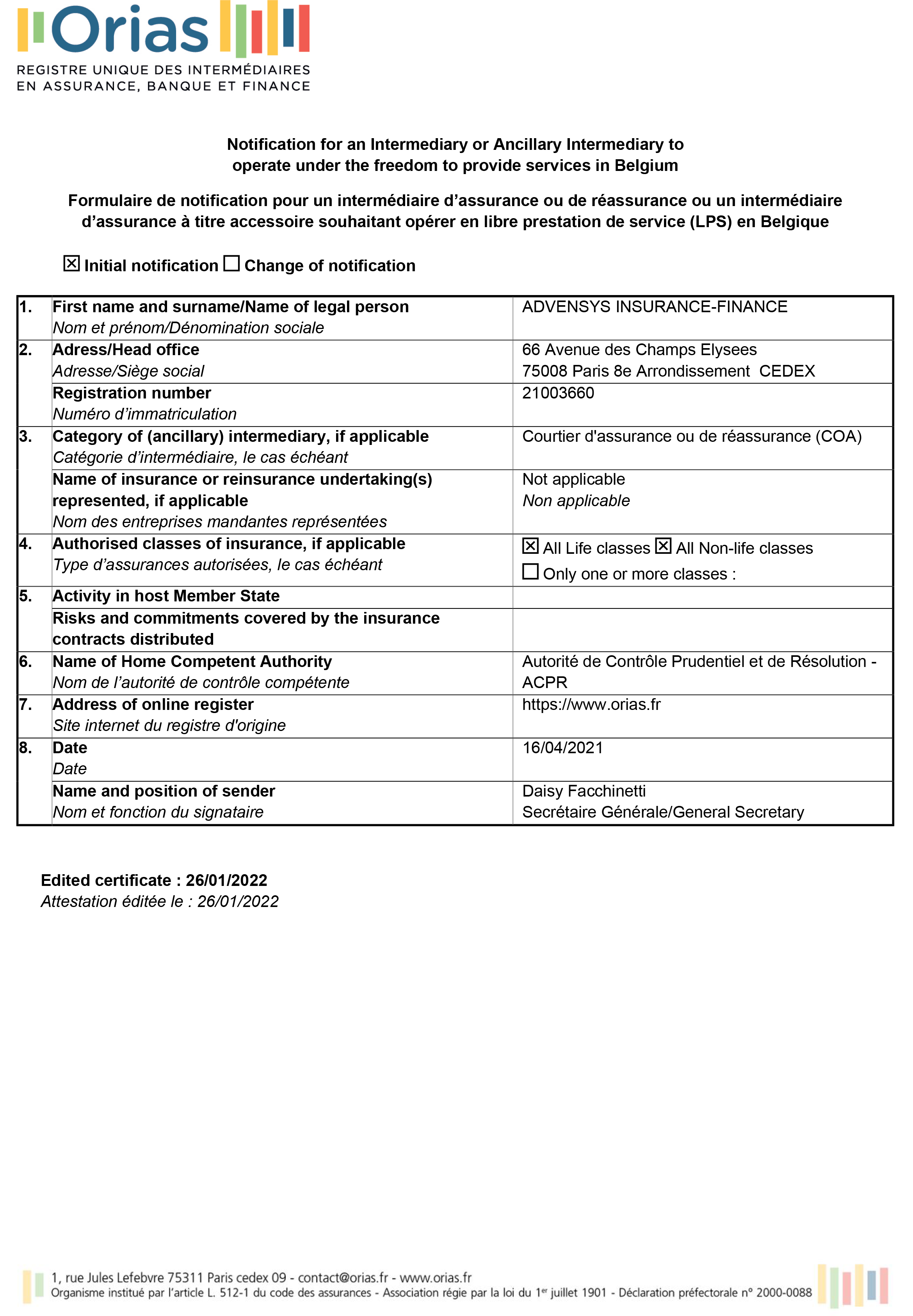

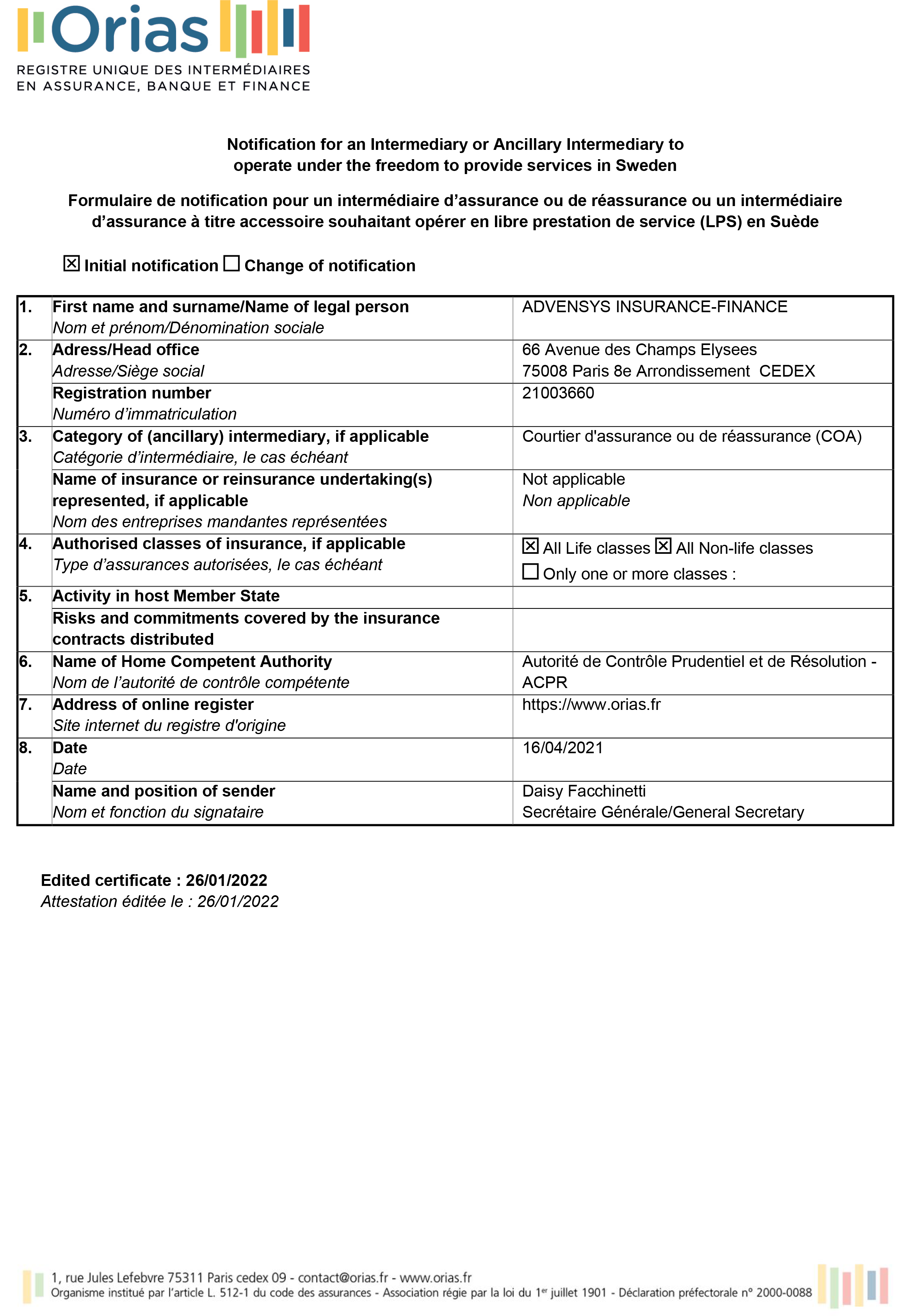

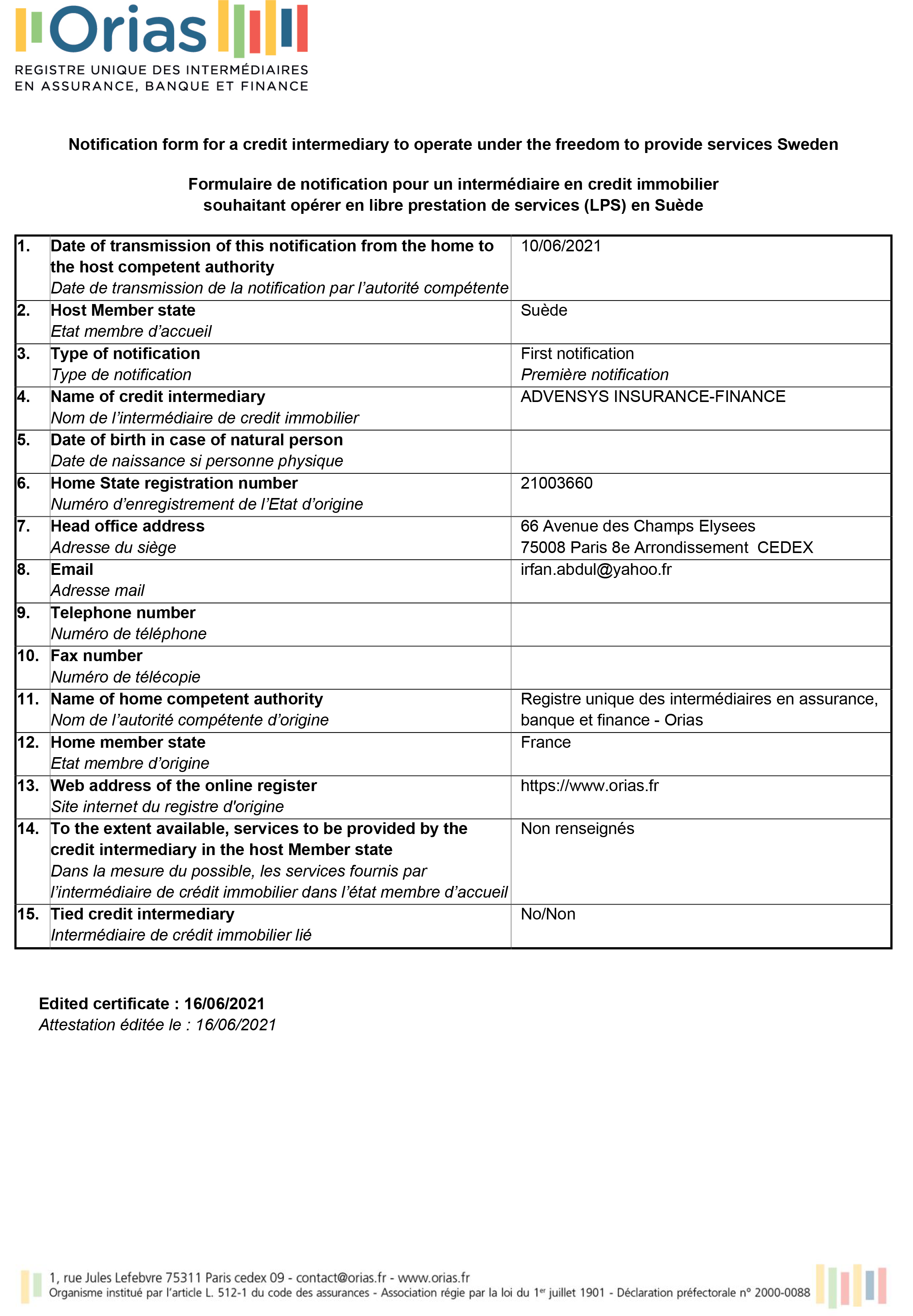

The industry has already received more than 163,850 claims from the catastrophe, according to latest available data from the Insurance Council of Australia (ICA).

ICA, which provided the figures on its Twitter account on Friday, says based on previous flood events the estimated cost of claims is now $2.451 billion.

Fitch Ratings says it expects net losses to primary insurers from the extreme weather in late February and early this month to be much lower than ICA’s current gross loss estimate due to high reinsurance recoveries.

But the rating agency expects gross losses may rise further as the Bureau of Meteorology (BOM) forecasts the ongoing La Nina weather event to lead to above-median rainfall in the second quarter for much of northern and eastern Australia.

“Recent flooding and severe storms in south-east Queensland and NSW will affect insurers’ earnings rather than their capital, as a result of strong reinsurance programs,” Fitch Ratings said.

“Insurers’ robust earnings and capital headroom should ensure their ratings remain resilient to these effects.

“However, higher modelled catastrophe losses and rising reinsurance costs in the face of increasingly frequent extreme weather events, coupled with reduced appetite from global reinsurers, pose risks to insurers’ credit profiles over the medium term.”

+46 72 529 81 26

+46 72 529 81 26

" alt="news" />

" alt="news" />

" alt="news" />

" alt="news" />